Author: David Drozd, Co-founder, President, Senior Marketing Analyst

Have you laid awake worrying about canola prices? Are emotions running high with each zig and zag of the canola market? If so, you’re not alone. Fortunately, there is a way to successfully navigate the ups and downs of the canola market.

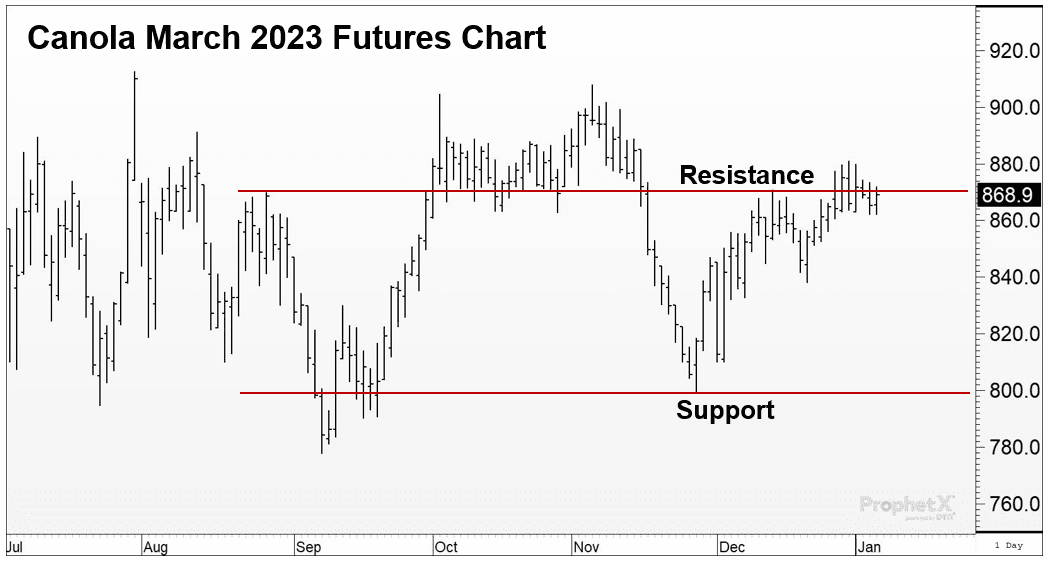

We’ll use the March 2023 canola futures contract for this illustration. The ICE Futures U.S. canola contract is the world benchmark for canola trading. This is where buyers and sellers determine the futures price of canola.

We’ll begin our story on November 28, 2022, when the price of canola on the March 2023 canola futures contract was $800 per tonne. The market had lost over $100 per tonne in less than three weeks and the phones at AgChieve were ringing off the wall.

Farmers were asking, “David is this market going to go down from here? If so, just tell me and I’ll sell every bushel right now. I don’t want to sell for less”.

Sound familiar?

I simply looked at the chart and said, “We’re not selling here. We’re expecting the market to turn back up”.

The market did indeed turn up as we expected. Four weeks later, it rallied to $880, a gain of $80 per tonne. On January 6, 2023, we made a recommendation to sell canola.

Why were we so confident the market would turn up and what made us decide to sell just before the canola market collapsed?

We simply relayed what the chart was telling us. We are experts in charting and technical analysis. This enables us to cut through the noise. I’ve been studying the markets for the past 40 years. This and the fact I grew up as a farmer and then worked as a commodity broker gave me the idea to form a company that helps farmers sell their grain for more. For the past 21 years, we’ve been promoting successful grain marketing strategies.

We believed March futures would turn up from the $800 area because we had identified support to be in the $790-800 area and the seasonal tendency was for canola futures to rally into January. This and the fact our phones were ringing off the wall is a barometer we have in the office that tells us the market is close to a bottom.

With prices falling, the news was extremely bearish, with the outlook for lower prices. Our job as advisors is to be the calm in the storm. We aren’t emotionally tied to the canola crop, as farmers are, so we are able to think clearly and make informed decisions.

By advising farmers not to sell at $800 and then making the recommendation to sell at $870 we put an extra $70 per tonne in their pockets. These farmers went from being worried to informed, and ultimately grateful.

We made the recommendation to sell because the March futures were struggling to exceed resistance in the $870 area and our technical indicators were in overbought territory, and therefore the market was vulnerable to turning down. We also realized that the concerned farmers who were ready to sell it all at $800, could take advantage of the rally before prices slipped away again.

3 key elements to marketing canola

- Know your inventory

- Know when to sell

- Know your price

Being aware of these three elements will help you when you’re thinking about marketing your canola. At AgChieve we believe that using tools such as Farmbucks and Combyne can help you feel confident about your marketing decisions. Let me show you how you can use each of these tools to help your grain marketing.

When marketing grain, time is of the essence. Right after we made the recommendation to sell, the canola market fell $80 per tonne to $790. This is why it is so important to keep your eyes focused on the markets. At AgChieve we watch the markets for you, so when you’re busy you won’t miss an opportunity because we’ll alert you when it’s time to sell. Our goal is to help you sell at or near a market high and avoid the inevitable low.

When AgChieve makes a recommendation to sell, their clients take note. Once alerted, they can quickly shop around for the best opportunity and make a sale. This is where the Farmbucks app comes in. Immediately, you can see the highest prices available, and where they are. You won’t have to think long about what price to sell your canola at.

The market won’t wait for anyone, so this is not the time to be figuring out how much grain you have for sale. When it comes to knowing your inventory, the Combyne app easily shows you how much grain you’ve sold, how much has been delivered, and how much left you have available. You can also keep track of your trade documents such as contracts, load tickets, and settlements on Combyne which automatically reconcile against your inventory to ensure you’re always up to date. With a few clicks of a button you can swiftly and confidently know how much to sell.

It’s important to have the right tools for the right job. By using the tools afforded by AgChieve, Farmbucks and Combyne, you’ll be able to make informed marketing decisions and sell your grain for more.