Author: David Drozd, Co-founder, President, Senior Marketing Analyst

How do you determine when to sell your precious commodity, canola? Do you flip a coin? Read the newspaper? Talk to your friends at the coffee shop? Ask the grain buyer’s opinion? Check the local weather? When you are in need of money? Or do you take the time to do the market research and make an informed decision?

Marketing is all about managing risk and it all starts with a market outlook.

It is important to determine the trend and when a trend is about to turn around.

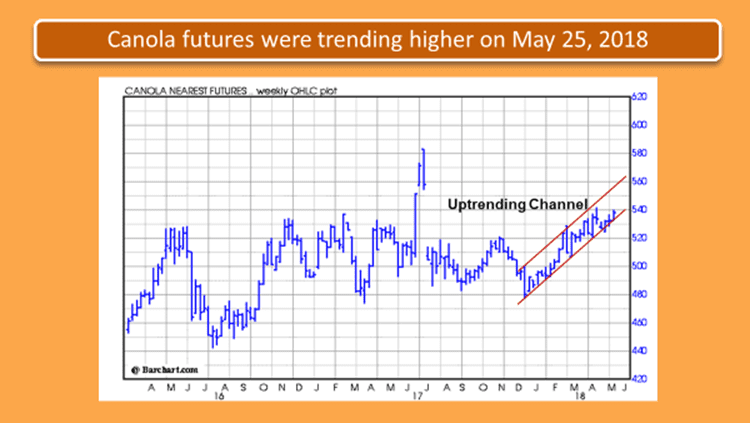

Developing a marketing plan begins by taking a look at the big picture to determine future price direction. The best way to get a snapshot is to look at futures and cash market charts. At a glance you can easily see where canola prices have been, where they are now, and from that, extrapolate where they are expected to head.

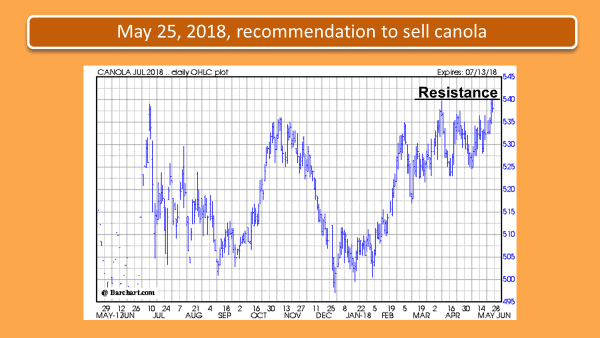

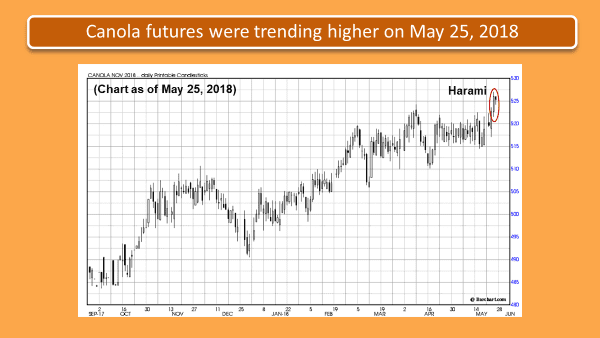

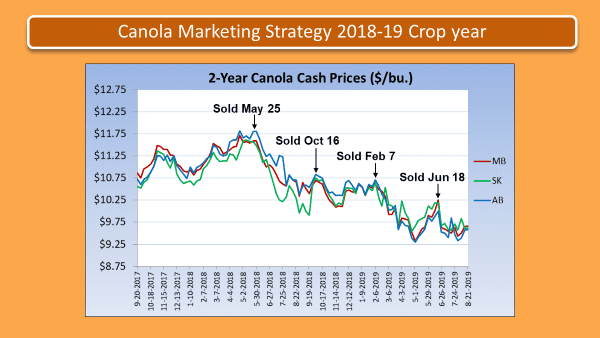

In analysing the canola market in the spring of 2018, my team of advisors and I determined the multi-year trend of rising canola prices was about to come to an end, so on May 25, 2018, we advised our clients to lock in the price of canola for the 2017-18 & 2018-19 crop year. This was our final recommendation to sell canola in the 2017-18 crop year, when canola prices were $11.75-12.25 per bushel for the June/July 2018 delivery period. This was also the date of our first recommendation to sell canola in the 2018-19 crop year with canola prices across the three Prairie provinces averaging $11.24 for October 2018 delivery.

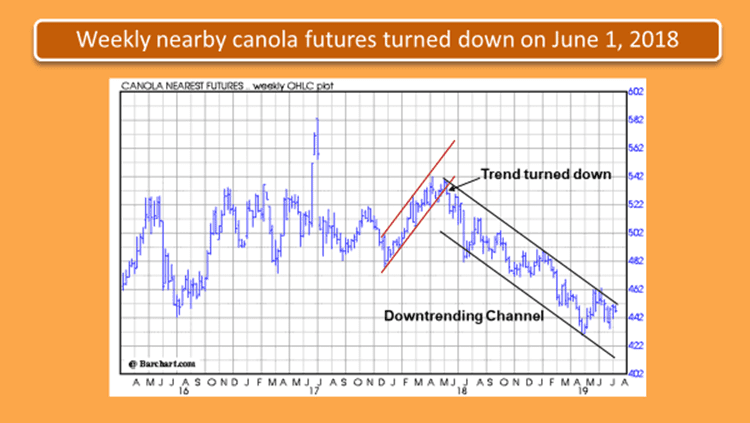

One week later, on June 1, 2018, canola futures turned down below the lower boundary of the uptrending channel, putting an end to the uptrend and signalling the beginning of a downtrend. This is our goal at AgChieve. To alert you when the market is about to turn down and to help you sell at or near a high before the inevitable downturn.

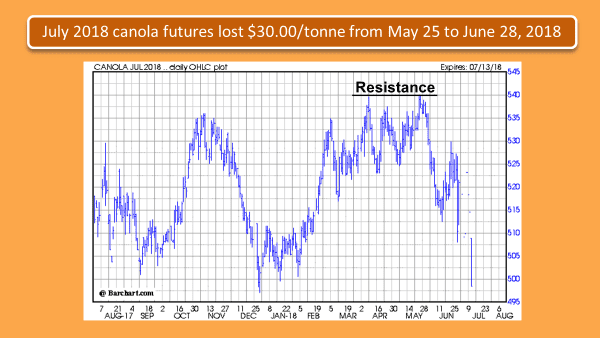

One of the reasons for our recommendation to lock in or hedge the price of canola on May 25, 2018 was the July 2018 canola futures had rallied into resistance at $540. Previous highs often become areas of resistance. An area of resistance is where the longs (buyers) are no longer willing to chase the market higher and where the shorts (sellers) are eager to enter the market.

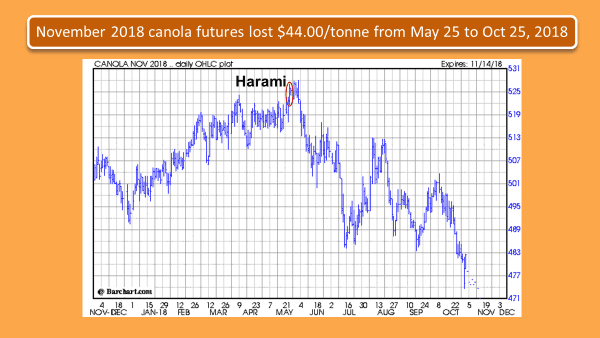

From May 25 to June 25, 2018, the July 2018 canola futures lost $30.00 per tonne. Prices can and often do turn down and collapse faster than they go up. It took the July futures five months to rally from $500 to $540 and only six weeks to give it all back. Is it any wonder, farmers seldom have a second chance to sell once prices turn down? The market waits for no one: not you, not I, nor anyone else. Hence, the importance of selling just before a market turns down.

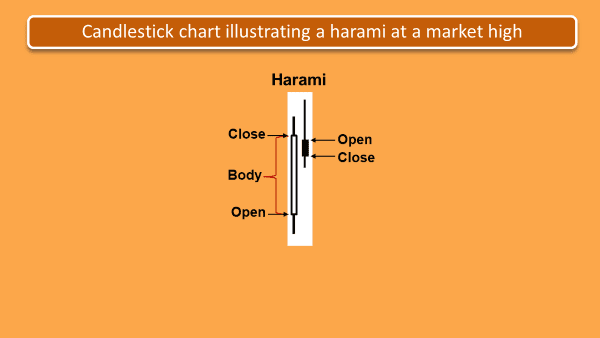

Another reason for believing the rally was about to end was that a harami appeared on the November 2018 futures candlestick chart on May 25, 2018. A harami is a reversal pattern, which has a fair amount of reliability, especially after an extended move in both price and time. This harami materialized at a new contract high, which increased the significance of this reversal pattern.

A harami, is a reversal pattern appearing on a candlestick chart. Each daily range is referred to as a candle and the area between the opening and closing price is referred to as the body. At a market high, a harami occurs when on the first day a market settles higher than it opens, creating a long white or open candle. The following day, the market starts out lower and settles lower than the opening, creating a short black or closed candle. A harami is a reliable indicator for signalling a trend change.

By the fall of 2018, futures prices were putting in lower highs and lower lows, indicative of a downward spiralling market. The spot price of canola on October 25, 2018 was $10.25 per bushel. Farmers who forward sold canola on May 25, 2018, were delivering canola in October for $11.25 per bushel. What would an extra $1.00 per bushel mean to you?

Who could have seen this coming? And if they did, why didn’t they tell anyone?

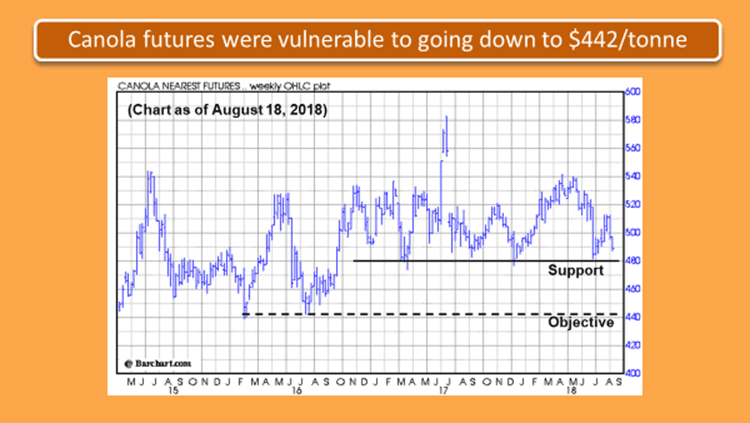

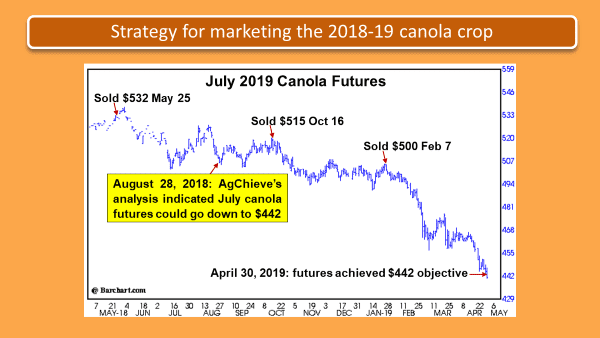

Well, we did! On August 28, 2018, our clients were asking us: if this is truly a bear market, how low could it go?

Our analysis indicated that support at $480 may not hold and if futures did break below $480, futures could drop to $442. This objective was achieved eight months later.

The July 2019 canola futures chart illustrates the days we made recommendations to sell canola. Based on our three recommendations, if you had used the July 2019 futures to hedge your canola, you would have had an average futures price of $515 per tonne. Lifting your hedge when the July 2019 futures reached our objective of $442 per tonne, would have yielded a gain of $73 per tonne. If you sold 300 tonnes each time we made a recommendation, you would have been short a total of $900 tonnes with a total gain of $65,700.00. If you are a larger producer and locked in a total of 3,000 tonnes, you would have yielded a gain of $219,000.00. A concern amongst producers, are the risks inherent in locking in grain prices before the production is in the bin. Farmers using the futures market to hedge their production are not obligated to deliver tonnage, as with forward pricing contracts.

While futures prices are what we tend to focus on, it is also important to monitor cash prices. Fortunately, charting and technical analysis works just as well for cash price charts as it does for futures price charts. The chart illustrates the dates we made recommendations for our clients to sell canola for the 2018-19 crop year.

Charting and technical analysis can allow you to determine the trend or trend change and know when to lock in cash prices, price a basis contract, short the futures market, and lift hedges.

Reading the charts is akin to reading a roadmap. Sure, there will be detours, bumps and possibly U-turns along the way, but ultimately you will get from point A to point B. The key is understanding the destination. If you know that the trend is down and there is a good possibility of lower prices in the distant future, would it not make sense to make a plan to market your grain accordingly?

In a bear market, it is important to sell grain when the market rebounds. The challenge is most producers tell themselves they will make a sale when the market gets back to the previous high. In reality, a bear market puts in lower highs on each rebound, so it is important to lower your expectations and your grain pricing orders.

Anyone who tells you charting and technical analysis does not work, is really telling you they do not understand charting and technical analysis.

Experienced chartists and traders will tell you they develop a sixth sense – they just know when to pull the trigger. In studying these markets and using charting and technical analysis for the past 38 years, I can attest this is certainly true. If you have any questions or comments you may contact me, David Drozd, senior market analyst, AgChieve.