Author: David Drozd, Co-founder, President, Senior Marketing Analyst

Do you know when to sell your grain?

Talking to hundreds of farmers at the 2024 Crop Production show in Saskatoon and Manitoba Ag Days in Brandon, we were surprised to hear how many farmers were either undersold or still holding 100% of their canola. We knew the trend had turned down in August 2023, but they didn’t, or they didn’t want to believe it. The news at the time was bullish with ideas this year’s yields were going to be disappointing. However, the news is always bullish at the top, so we rely on charting and technical analysis to cut through the news (noise).

The canola market has gone down $200-220/tonne ($4.50-5.00/bu) since August 2023.

A lot of farmers are hoping prices will improve. There’s a herd mentality in believing no one could have foreseen this downturn. However, to an experienced grain marketing analyst, it was clear the market was going to turn down.

Marketing grain is all about managing risk.

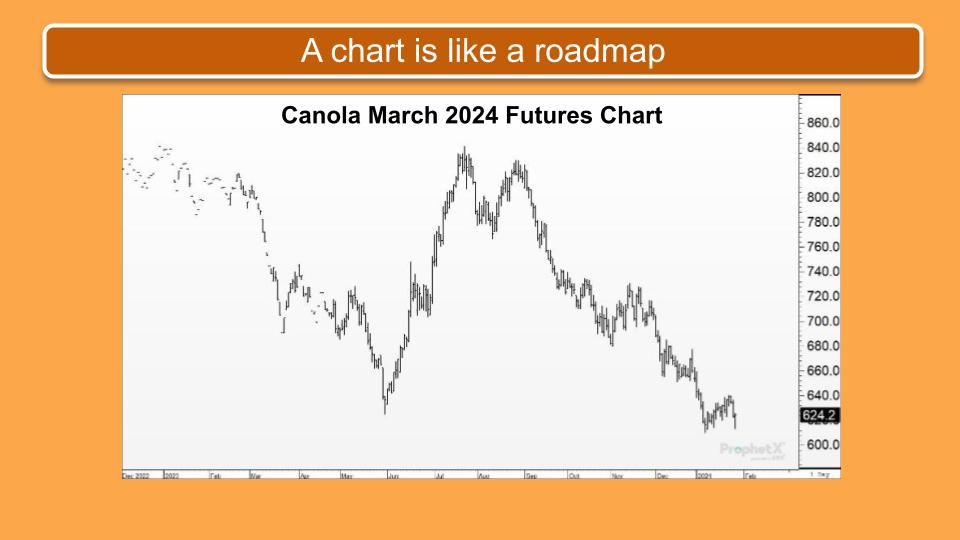

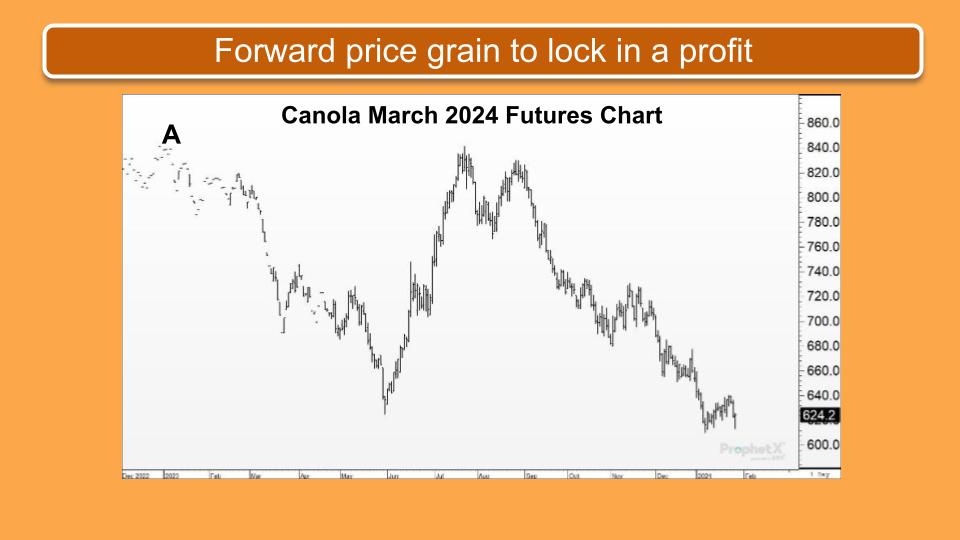

Making an incremental sale before an inevitable downturn has many advantages, which I’ve listed at the end of this article. I believe in educating farmers on ways to market grain, so I’d like to reference the March 2024 futures chart to illustrate the ebb and flow of the canola market. Reading a chart is like reading a roadmap. It shows where you came from, where you are, and where you are going.

Be Proactive, NOT Reactive!

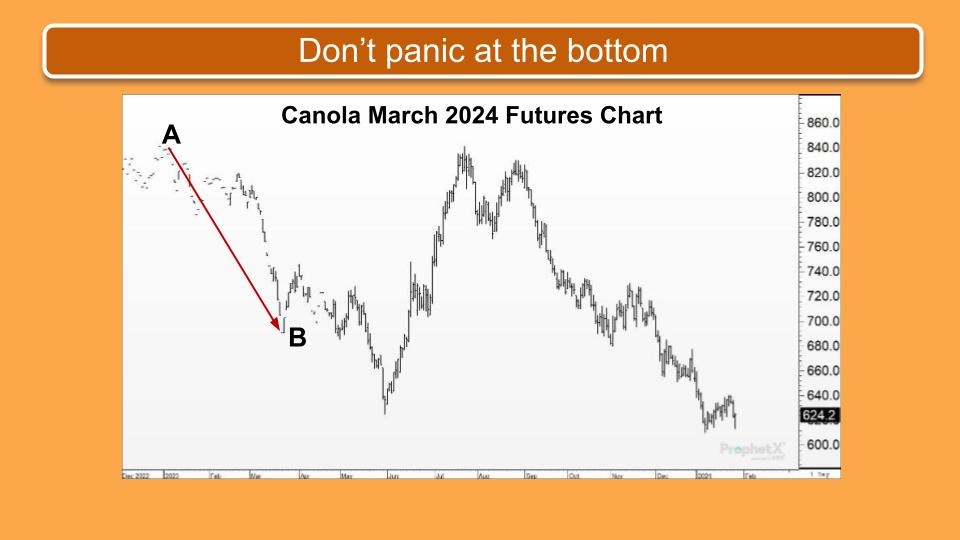

This journey began one year ago on January 4, 2023. Referenced as (A) in the accompanying chart, the canola market had rallied into resistance and was at risk of turning down, so we advised our clients to start selling their 2023-24 canola production. Prices were $18.00-18.50 for October 2023 delivery.

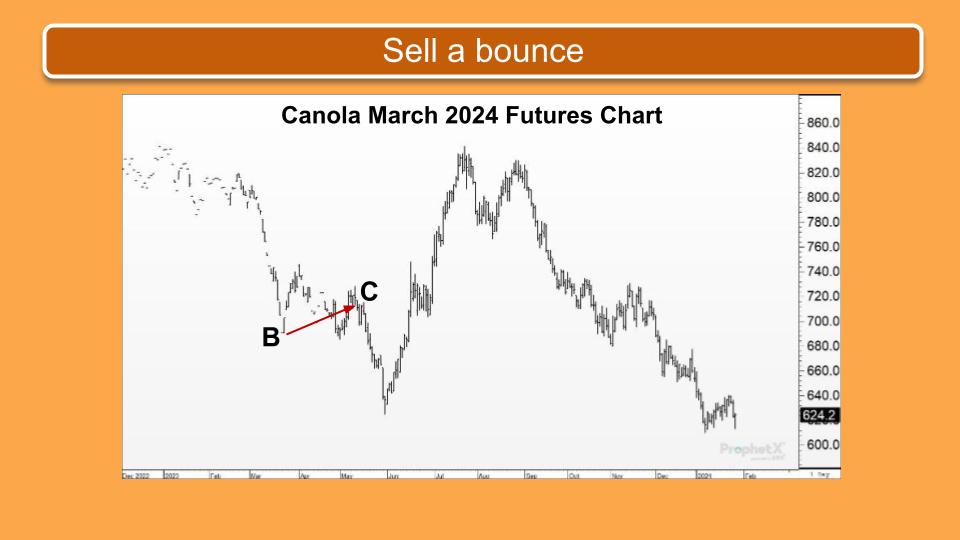

In less than three months, the market lost $3.00 per bushel. At the bottom (B), on March 22, 2023, our phones were ringing off the wall. Farmers who were not yet subscribed to AgChieve were frantically calling and asking if they should sell. We said not to sell because a reversal pattern had appeared on the futures chart signalling the market was about to turn back up.

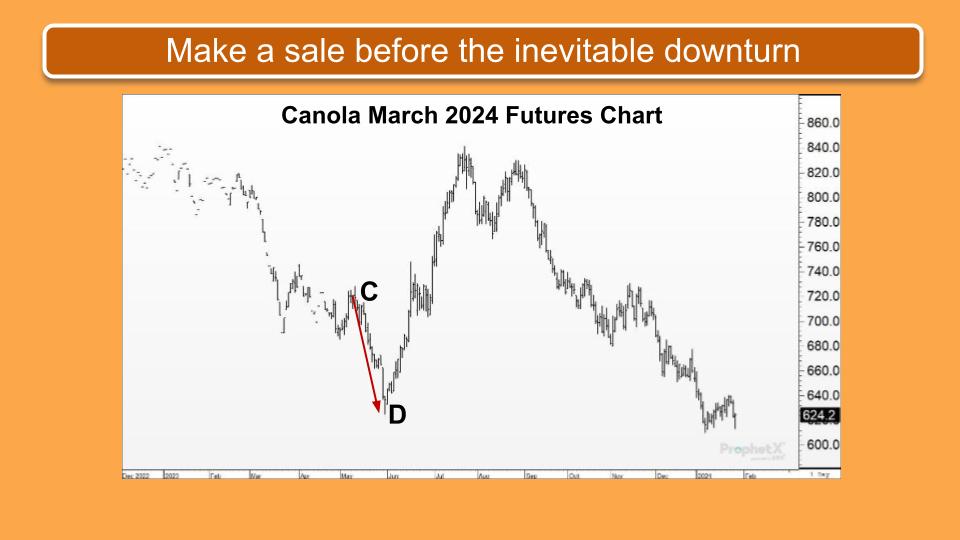

The market went up, and on May 12, 2023 (C), we made a recommendation to make an incremental sale.

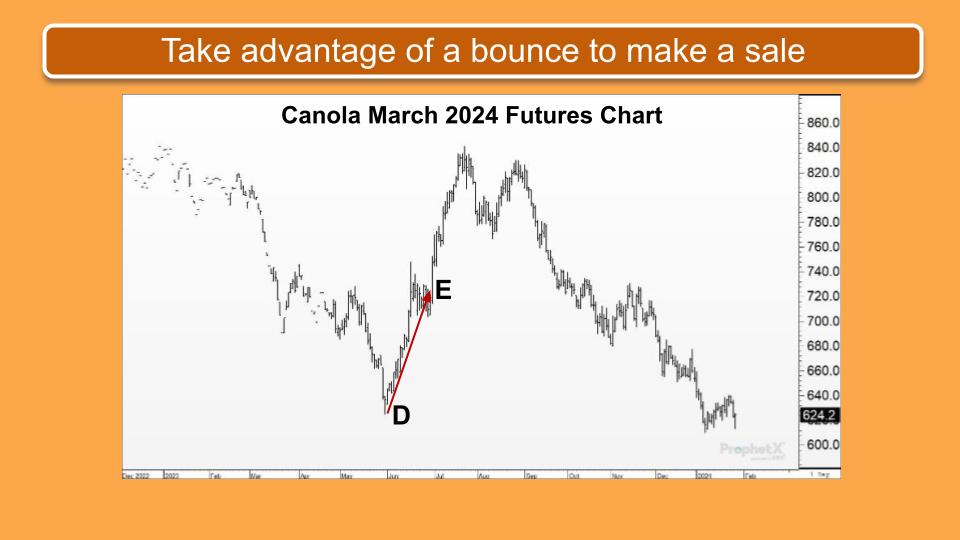

The market quickly lost $2.00 per bushel and on May 31, 2023 (D), we were once again getting calls from worried farmers asking if they should sell. We said we were not selling and advised them not to.

The market rebounded $90.00 per tonne and on June 29, 2023 (E), we made a recommendation to make a sale. Those who we advised not to sell at the bottom (D) were grateful we helped them make $2.00 per bushel.

Chart Patterns Predict Future Price Direction!

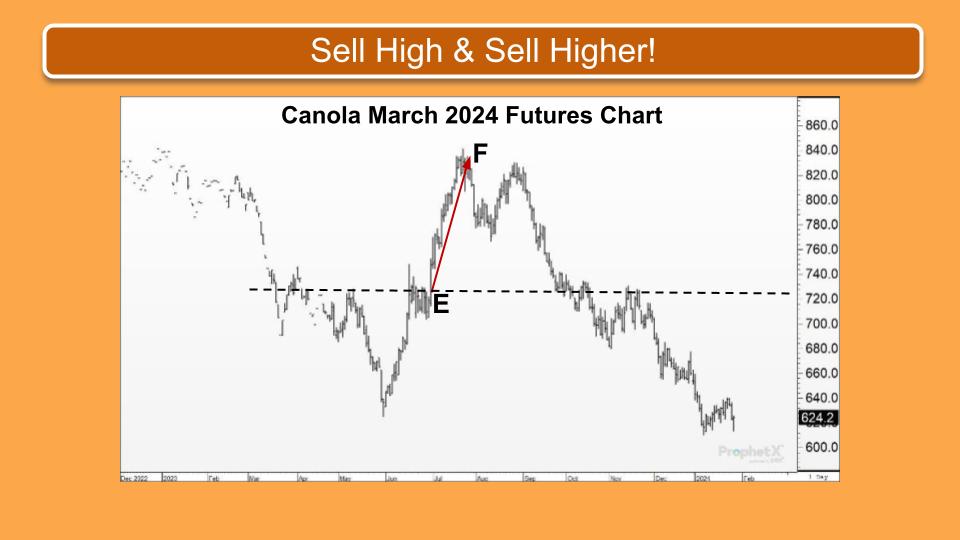

In July 2023, the market pushed through resistance at $725.00 (E) and rallied to $840.00 (F). We were at Ag in Motion at the time telling farmers that came by our booth this market was about to turn down. This was because the market had rallied into resistance and achieved the $840 objective provided by a bull flag formation that developed in June 2023. However, farmers were reluctant to sell because they were unsure of their production.

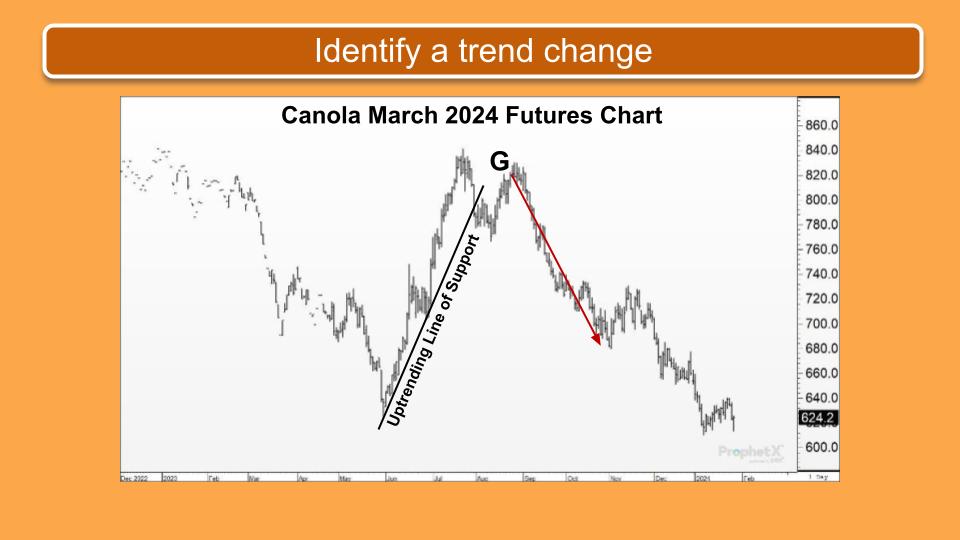

When futures dropped below the uptrending line of support in August 2023, we knew the trend had changed and we had to sell the rebound. On August 24, 2023 (G), we alerted our clients to sell canola because the market was about to turn down. The market stayed up for six days, more than enough time for our clients to get their canola sold, just before prices fell $3.00 per bushel.

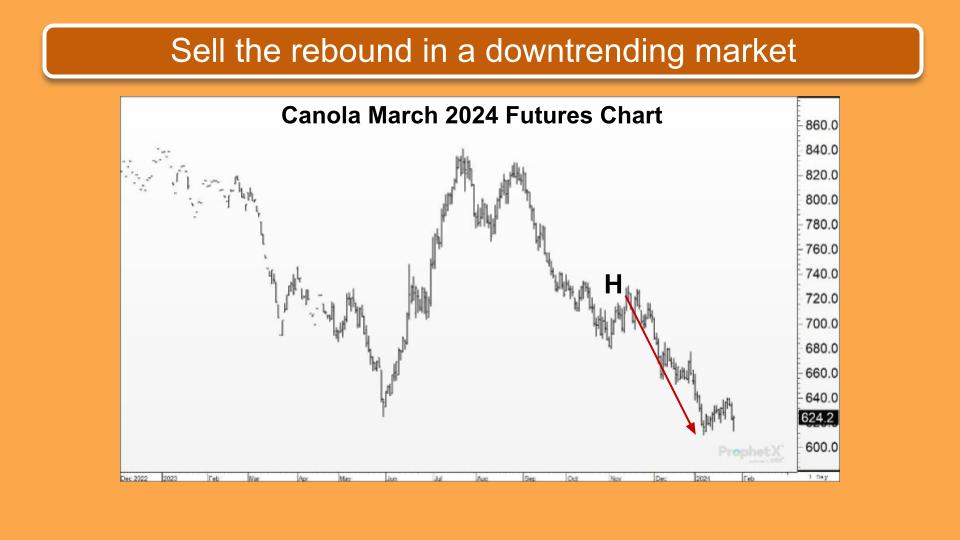

Marketing Canola When the Trend is Down

Knowing how imperative it is to sell the rebounds in a downtrending market, we made another recommendation to sell canola on November 7, 2023 (H), before prices fell $2.00 per bushel.

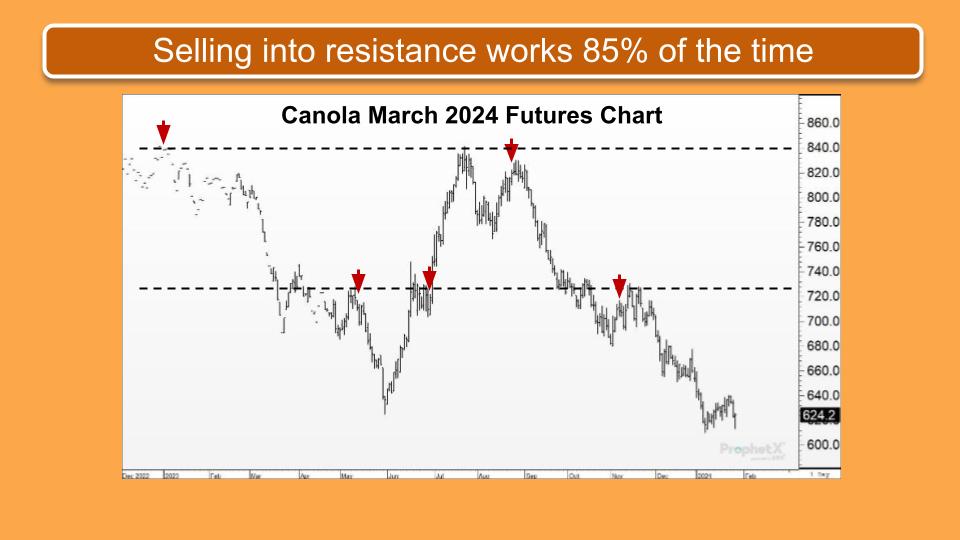

Our discipline is to make a recommendation to sell grain when a market is at risk of turning down. Making an incremental sale when a market rallies into resistance works 85% of the time. Resistance levels on the March 2024 canola futures chart are shown here by the dashed lines at $725 and $840. The red arrows indicate the days we advised our clients to sell canola in the 2023-24 crop year.

Advantages of making a sale when the market is at risk of turning down

- Locks in a profitable price

- Reduces price risk

- Lessens stress

- Lowers the cost of storing grain

- Locks in prices for picking up grain bags and delivering to an elevator or crusher before spring melt. It costs time and money to put it in a bin and take it out again

- Delivering grain decreases the risk of spoilage

- Keeps peace amongst farm partners

- Less anxiety about whether the market will turn back up

- Not forced to sell canola for cash flow when the market is at a low

- Sleep better

- Enjoy life, and isn’t that what farming is all about

We have clients who’ve sold most of their grain at harvest in each of the past two years. They were focused on preserving their record high gross revenue. Those who focused on price were reluctant to sell because the price wasn’t high enough. I encourage you to check out my blog “Think Revenue, Not Price” posted on our website, www.agchieve.ca.